Monthly CalendarĪ monthly calendar is a must in your monthly budget planner because it’s essential to know when you get paid and when your fixed or recurring bills are due.

I am a big proponent of getting out of debt sooner than later because getting back control of your money will enable you to grow your net worth at a much faster rate than dragging out debt payments over the life of your loans.

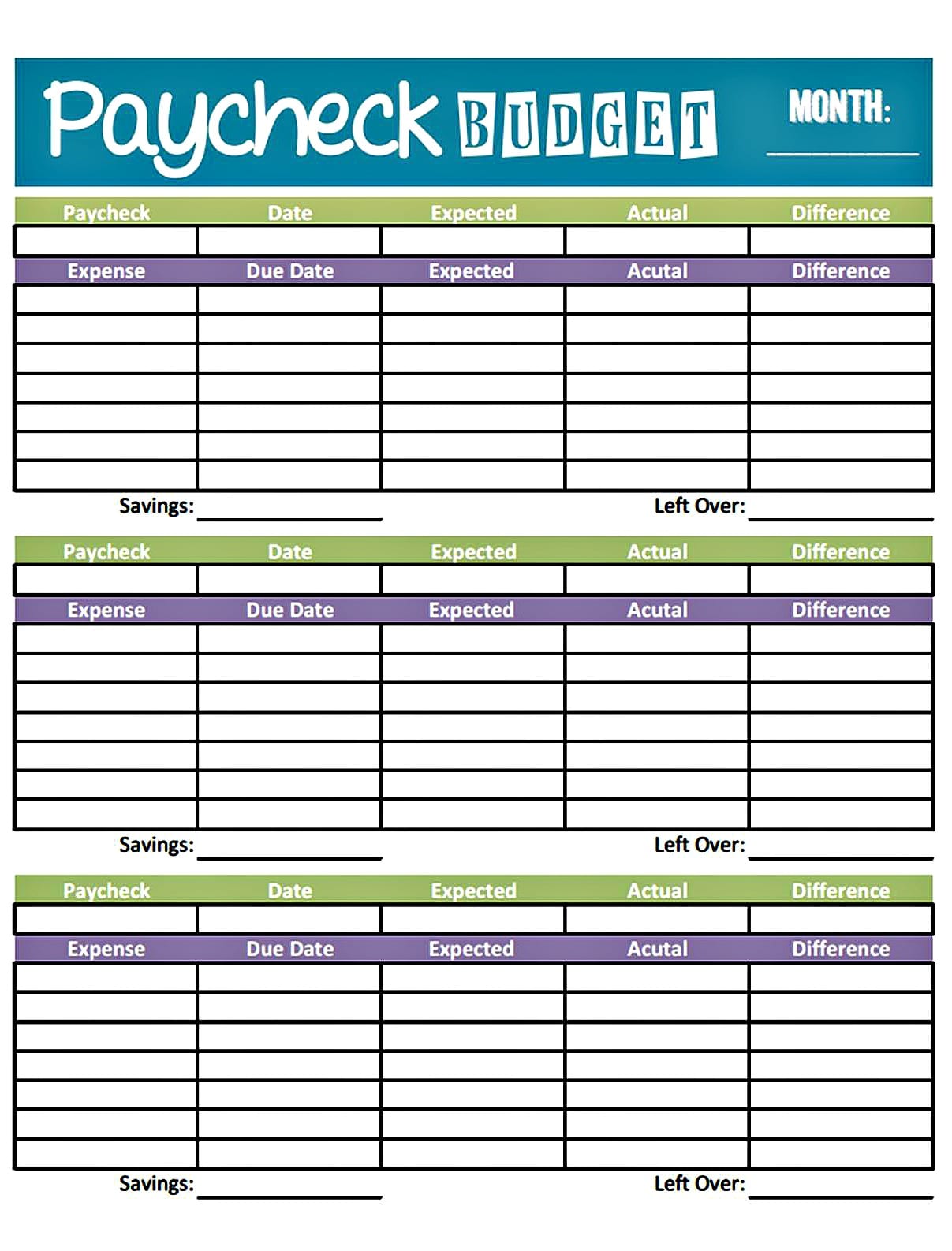

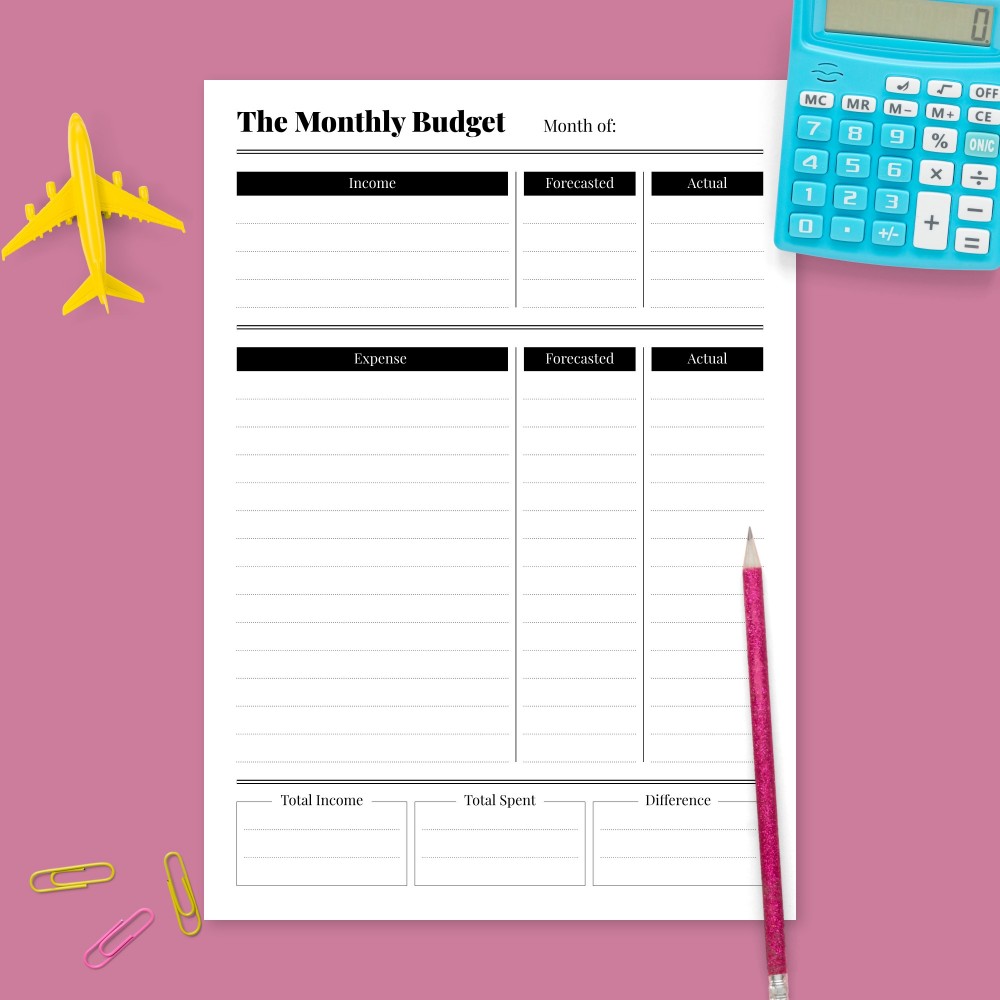

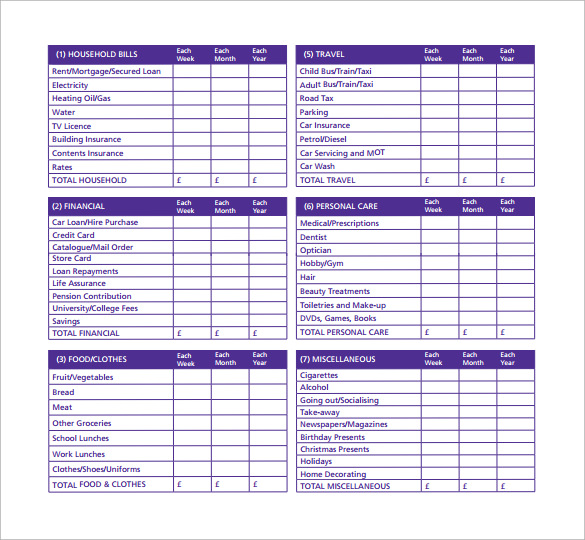

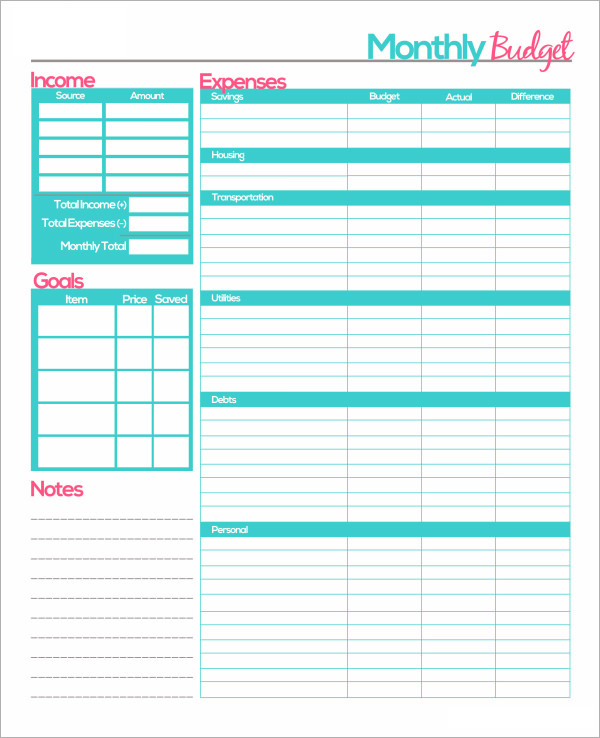

Estimated and actual expenses trackers divided by categories.Monthly Budget Planner SectionsĪ good monthly budget planner should include at least the following sections or features: But, after all, you work hard for your money you should work even harder to make it work and grow for you. A monthly budget planner requires an investment of your time.

When you focus more on figuring out your income and expenses, your will make better money decisions.Įven if you are resisting the idea of writing all your expenses down to budget, give yourself a chance. Doing the math on paper requires that you pay more attention. In the short and long term, budgeting on paper will give you better results with your money. You can start one using a blank notebook or buy one of the many available in the market. What Is A Monthly Budget Planner?Ī monthly budget planner is a workbook that you use to calculate and track your estimated and actual monthly income and expenses. Occasionally, I use the spreadsheet to map out different spending scenarios and show my husband the numbers. Since then, I’ve upgraded from a legal pad to a budget binder to a monthly budget planner I personally designed. Start a simple monthly budget planner book on a legal pad or notebook. That visceral feeling of knowing where our money had gone was a great wake up call, one I was utterly missing for years when using digital tools to budget. I filled out an entire sheet with all our grocery store purchases adding up to almost $1,500!Īre you kidding me? What the heck did we buy at Walmart? Did we buy the entire store? The first time I wrote all our expenses down, I got sick to my stomach. Using a legal pad, I started doing my monthly budget and expense tracking on paper, and oh boy, was I up for a rude awakening. Then, I decided to go old fashion and use a budget planner book. Also, I didn’t register my spending emotionally. But that also didn’t change anything for me! There was something about tracking expenses digitally that I did not enjoy. So, I decided to give budgeting with an app a try. After all, I would spend most of my day at work behind a screen. I dreaded getting on the computer to budget. unlike Budgeting on excel or an app a budget planner book allows you to register your spending emotionally too. However, sometimes, in fact, many times, I would go weeks without looking at my lovely spreadsheet, hence not paying much attention to my expenses. I could copy my template from month to month, getting a head start. Budgeting electronically saved me time as well. It was easy, practical, and my husband liked that method. I know this because, for over a decade, I used an Excel spreadsheet for our household budget. Writing down your income and expenses will make you more aware of the REAL estate of your finances. Why is budgeting on a book or notepad better than electronically? For a simple reason. But I believe that the best way to manage your money is using a monthly budget planner. Some people use spreadsheets, and others use apps.

There are many ways to budget your money.

0 kommentar(er)

0 kommentar(er)